ONLINE EXCLUSIVE:

Real-time SCM, Risk and Recovery Before Disaster or Revolution Hits

By Patricia E. Moody

|

|

| Like an early-warning system, Real-time SCM monitors massive amounts of data and has become a concept that is “a feasible alternative for companies who are trying to optimize supply chain performance and reduce supply chain risks.” |

Even if 14 percent of outsourced manufacturing (per a recent MIT look at the tragedy of outsourcing) comes back to The Americas, even if all of those factories are relocated, allowing shipping to customers within 24 hours, even if your company makes products whose recipe includes fewer than a dozen ingredients, even if the sun doesn’t shine tomorrow —we’ll still be looking at global supply networks susceptible to risk.

Pull systems and electronic kanban are insufficient, as Toyota, Honda, dozens of suppliers and makers of so many consumer goods know about successful risk and recovery. Supplier events or disruptions, as disaster expert Betty Kildow says, are best anticipated well in advance.

Nissan Vice President Rebecca Barker Vest discussed her company’s remarkable recovery after the Japanese earthquake. Honda serves as a case study in response to supplier disruptions such as the WEK fire, as does Toyota’s labored response to similar events. Strong organizational lessons to be learned from each one. Now with the cheap availability of Big Data, early warning IT systems, such the ones that Mike Romeri of OpsRules talks about, can harness the intelligence three steps ahead of the next big one.

Organizational response

There’s an unmistakable element of flexibility that should kick in when disaster strikes. Think EMT and 911 calls in New York City, where a human emergency happens every minute. If your trucks are ready and your people are trained, then no sooner does the 911 call come in than they are sliding down the poles into their boots, emergency medical kit or toolbox in hand, ready to respond and attend to a multitude of emergencies. That’s the way Honda got through the WEK fire. Supplier engineers based in purchasing who already knew the supplier’s factory flows, as well as its production levels, put on their boots and in one weekend moved critical molds from one plant to another. Problem solved, thank you.

Vest said Nissan took a similar approach after the Japanese earthquake. Within two hours of the initial event, critical personnel from Japan and Tennessee were on conference calls while others ran for the airport to track down parts on trucks and at the docks. No one knew exactly how bad the damage would be, or which lines, even which suppliers or plants, would be disrupted. Certainly for Honda, Toyota and many suppliers, the financial markets continue to show aftershocks even months later. “Nissan’s operating approach is focused on achieving results and meeting our commitments. We believe strongly in the value of creativity. We believe that we must proceed in a manner that promotes trust and transparency and that drives our ability to be responsive and take quick action when the situation calls for it,” Vest said. “Within 24 hours we assembled a cross-functional crisis team in the Americas region, working in alignment with our global partners. I assembled this team with members from the United States and Mexico — about 10 to 20 people — and some of these team members were dispatched to Japan. The team size varied during the crisis depending on what was needed. The concept constantly changed in response to the business need at the time. Not all team members were from purchasing, Some were from supply chain management, research and development, and manufacturing. All of these related groups worked together and sent some people for my team.”

Like the Minutemen who dropped their plows, grabbed their muskets and saddled up for the Battle of Lexington, these crisis management teams had broad and deep knowledge of their parts and suppliers. Vest pulled people off their regular jobs and told them, “You no longer have day-to-day responsibility for what you did yesterday. Today you are responsible for earthquake management.” She held twice-a-day meetings, including the function VPs in the region and additionally, twice-a-day meetings occurred with the team members and counterparts in Japan. “We had voices on both sides of the world that were up-to-date on what was happening and could answer detailed questions,” Vest said.

It’s interesting to note that Vest’s team — she manages seven sites — was operating out of a global corporation that included professionals from many geographies, cultures and most importantly during a crisis, languages, reflecting the kind of diversity one would expect of a company led by the charismatic Carlos Ghosn. “English,” Vest said, “was the common language,” and that meant that crisis team members could communicate directly — no translators or coordinator intermediaries — and immediately with their supplier colleagues. Working in a common language allowed the team to take action literally within hours of the earthquake as a region. “We decided right away,” she said, “that we would take action as a region to do everything in our power to avoid stopping production and to support and protect our suppliers because we knew that if we go down, they go down.”

Things got pretty hectic, with electronics chips posing unique challenges, as well as some castings and forgings. In-house castings and forgings were sourced from the Iwaki plant, which is just outside of the Red Zone in Japan, “So they had to recover,” Vest said. “Our people at Iwaki put in miraculous efforts. They had to rebuild a significantly damaged plant. From our end, we reallocated production requirements, we pulled vacation time so that, in effect, the production curve went down in Q1,” which Vest referred to as a unique approach to moving production, a real gamble, that in the end worked. “When the earthquake hit, we were very quick to figure out how to do that,” she said, “and the reason was close communication with the plant, design and purchasing, lining up which parts went on which car. Remember I said that Nissan is known for its creativity? Well, this is a perfect illustration. If we knew we couldn’t get a particular part of the navigation system (part “A”), the design guys would step in and say, ‘well, if we can’t get that part, let’s substitute,’ and very quickly they would check with the plant and with sales, and then they would allocate production to an alternative (part “B”). So this was a system-assisted recovery supported by very methodical checking for quality and safety to ensure that the substitutions would maintain vehicle quality.”

The results continue to amaze and please Wall Street, where Nissan reports 8 percent profit margins and a steady stream of new vehicle introductions despite the disruptions. Vest attributed the recovery to a corporate philosophy that demands speed “with a strong sense of urgency, working together as a regional team. We weren’t waiting for Japan to tell us what to do.“

Romeri and other supply chain experts have said that big data intelligence holds the key to anticipating and dealing with complex global crises. “Firms with global supply chains need to manage risk carefully as they apply lean techniques to optimize the performance of a global supply chain. Supply chains that are ‘over-leaned’ have short cycle times and minimum inventory but can perform poorly when disruptions occur.

“The problem faced by many firms is that the six-sigma lean program is the only game in town. Companies have spent truckloads of money training individuals and teams and using this expertise to dig into high-priority operating problems. There is no doubt that firms worldwide have benefited enormously from their emphasis on lean, but like any best-practice technique, apply with care and consider the scale and unique characteristics of the problem you are addressing.”

What would you do with end-to-end transparency if you had it?

“The current state within many global supply chains is near chaos,“ Romeri said. He views time zones and culture differences as contributors as well as data silos. To that list, he would add a rusted out IT infrastructure and unplugged or fragmented systems. Romeri takes his analysis even deeper. “Too often, six-sigma enabled continuous improvement programs take the place of mindful operations strategies,” he said. “Firms that rely so heavily on six-sigma forget that it is fundamentally an analytical and implementation methodology and overlook the need to inform and prioritize six-sigma business objectives in line with a well-understood operations strategy.” He recommended thinking about Real-time SCM, a concept that has become “a feasible alternative for companies who are trying to optimize supply chain performance and reduce supply chain risks.” Like an early-warning system, Real-time SCM monitors massive numbers of transactions and other data keying on indicators such as late payments or safety-stock violations.

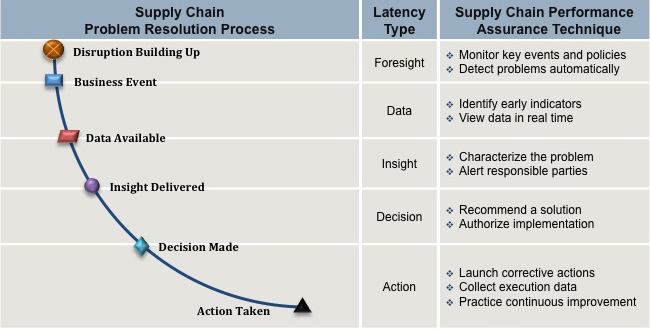

“Forward-looking companies such as Toshiba are beginning to think about their global supply chain networks the way telecommunications companies think about their network operations centers (NOCs),” Romeri said. “They want to minimize the delay in detecting evidence of a problem and taking the necessary steps to investigate and resolve the problem.” Research by Georgia Tech Professor Vinod Singhal indicates that late detection of an important business event is the most likely cause for a major supply chain disruption. Current company practices are most developed in the area of reacting to an identified supply chain problem. Real-time SCM focuses specifically on reducing the delay (i.e., latency) in the problem identification and resolution process in order to minimize disruptions. The chart below shows a conceptual diagram of the Real-time SCM process.

Siemens implemented a pilot program using software from Tibco and Microsoft, resulting in 30 percent cycle-time and process cost reduction. Although real-time SCM solutions are still at an early stage of development, Romeri predicts that companies will find they have opportunities to reduce operations costs by 10 percent to 30 percent and significantly minimize the risk of supply chain disruptions if they focus on reducing the time it takes for them to identify and resolve adverse performance trends before there are significant consequences for the firm. Estimates for software costs to get into the game are under $100,000.