CEO, 3Diligent, www.3diligent.com

There's a famous technology maturation curve called the Gartner Hype Cycle that spells out the phases of technology adoption. It provides a useful reference point for what we can expect from the 3D Printing industry in 2017.

At first, there’s a technology trigger, or market need. As word gets out, hype starts to build around this emerging solution to that market need. The hype continues to build until it far exceeds the actual capabilities and benefits of this young but promising technology. This, in turn, creates a "trough of disillusionment" where potential users dismiss the technology based on the fact that it so recently fell short of the market’s expectations. But once the technology wades through this trough of disillusionment and expectations are reset to match reality, the technology can mature into a mainstream solution.

3D printing’s maturation fits this cycle almost to a T. Conceived to build up parts layer-by-layer rather than cut them away from a block of raw material (machining) or cast them in a mold, 3D printing provided its users a way to more rapidly iterate on prototype designs.

The technology was born back in the 1980s and lived in relative obscurity, housed in R&D labs and job shops across the country, for almost three decades. Then, in 2014, hype started building around the technology due to a few key developments. First, industrial grade materials and technologies arrived on the scene. Suddenly, printing in metal or extremely high definition resin was possible using industrial grade machines.

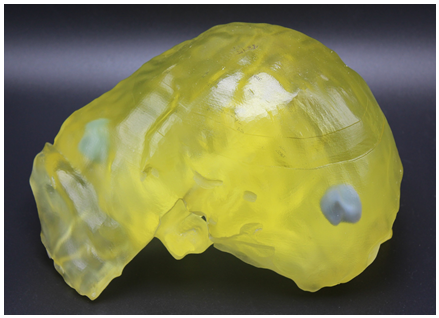

In parallel, a collection of key patent protections for the original 3D Printing processes expired. This allowed for “desktop” printers – smaller, “lite” versions of industrial machines – to hit the market at a price targeted toward the consumer market. So, at the same moment stories of customized medical implants and super-lightweight printed aerospace parts were being passed around, so too crashed a wave of stripped down consumer printers for under $2,000.

Naturally, consumers who thought they were getting something approaching a Star Trek replicator were a bit disappointed when they started trying to print. Then, as the industry recognized that much of the infrastructure that would support consumer printing – like intuitive computer design and push button printer functionality – were not in place, disillusionment built and a trail of depressed stock prices was left in its wake.

But now, as expectations have reset and the attention has returned to commercial and industrial applications, the industry is building momentum again. Mega-corporations like GE and HP are making massive investments in 3D Printing. 3D Printing startups are fetching healthy valuations from the venture capital community. Most importantly, manufacturing companies of all sizes are taking note of 3D Printing and building it into their strategic plans. As we enter 2017, the market is defined by a few key trends:

Plastic and Resin Printing is Getting Faster

While 3D Printing grew up as a prototyping technology, its ability to economically handle production volumes will dictate whether it is truly able to usher in another Industrial Revolution. Production runs require a higher level of speed, precision, and reliability. New offerings that are now entering the market promise at the very least the speed that will help 3D Printing compete with urethane casting and injection molding.

This emphasis on speed is coming from new entrants and incumbents alike.

Recently, HP has made waves declaring its entry into the market with a “Jet Fusion” line of printers, which promise speeds 10 times faster than incumbent nylon printing technologies like extrusion and laser sintering. Carbon, a startup backed by a few hundred million dollars of Silicon Valley venture capital, also made waves two years ago claiming print speeds 100 times that of existing resin printers. It has publicly stated its intentions to displace injection molding with its technology.

These new players represent a swath of new entrants in the market, and all of this activity has not gone unnoticed by industry veterans like Stratasys, 3D Systems, and Envisiontec. Each have introduced new equipment that is oriented around higher speeds and more production applications.

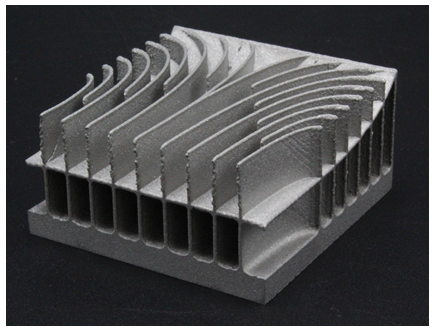

Metal Printing is Going Mainstream

Metal printing started gaining meaningful traction with industrial customers around the time that the consumer printing hype was kicking into overdrive. The single biggest story driving this traction was GE’s announcement that it had 3D Printed a rocket fuel injector nozzle and was planning to utilize 3D Printing for its production run of next generation LEAP jet nozzles. And if this didn’t signal to the market that GE was serious about a metal 3D printed future, then their recent announcements about acquiring metal printing OEMs Arcam AB and Concept Laser did.

2017 promises to be the year that metal printing goes mainstream. While metal printing processes don’t offer the same sort of speed as plastic and resin counterparts – typically metal printing requires meticulous melting of powdered metal with focused laser or electron beams – it can be an effective option for highly complex geometries and long tail parts with low production quantities. With GE leading the way – and key agencies like the FAA and FDA providing guidance and approvals – metal printing is gaining visibility and companies of all sizes are starting to explore potential applications. In 2017, you can expect to read more stories about metal printing in select high-profile production contexts.

Software and services pull it all together

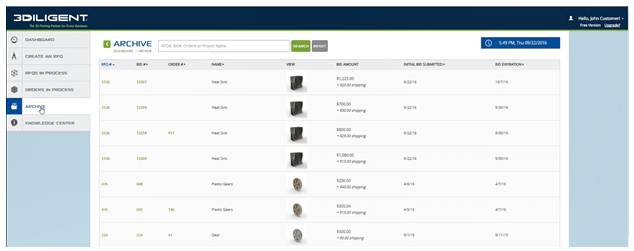

With all of the activity happening in the hardware and materials, software and services are also being developed to support the maturing market. Companies like Autodesk, OnShape, and to a lesser extent Dassault, are pushing to develop cloud-based CAD design solutions to support R&D teams working literally anywhere there is an internet connection. In parallel, companies like 3Diligent are using software to network suppliers who have invested in these emerging technologies to provide companies a single service through which to access the ever-diversifying range of options.

Conclusion

In summary, the 3D Printing industry built a ton of hype – some of it justified and some - especially around in-home printing – proved to be premature. But now, expectations have recalibrated around 3D Printing’s professional and industrial applications and aspirations. 3D Printing is already a critical tool for prototyping, tooling, and certain short run production applications. As 3D Printing technologies continue to proliferate and improve, you can expect the industry to continue growing at a brisk pace, fueled by an increased number of production applications for 3D parts.